Future of Sports Betting in America: What to Expect in 2021

The future of sports betting in the United States looks bright in 2021 and beyond. Despite the sudden COVID-related suspensions of nearly all sports early in the year, 2020 saw explosive, sustained growth for legal sports betting, both in terms of market expansion in legal states and new legislation paving the path to regulated sports betting in additional locations.

Looking ahead, investors, sports fans, and longtime bettors are all wondering – which states will legalize sports betting next?

SportsBettingDime.com sat down with two leading attorneys and industry experts to get their take on the future of sports betting and which states will be next to get in on the action.

Mark Balestra is US Special Counsel with Segev LLP and Jeff Ifrah is Founding Member at Ifrah Law. In their roles counseling and litigating on a variety of regulatory and corporate issues in the online gaming space, Jeff and Mark have a front row seat to observe the changing tides of sports betting in America.

Here’s what they think about the rollout of the legal market to date, and where things might be headed next.

Where Is the Market Headed? Legal US Sports Betting in the Next Five Years

Outside of Las Vegas, legal sports betting in the United States was largely non-existent until 2018, when New Jersey launched their online market after the US Supreme Court struck down the Professional and Amateur Sports Protection Act.

This landmark decision opened the door for every state to legalize and regulate sports betting as they see fit. Things have heated up quickly since then.

As of February 2021, twenty states and the District of Columbia have some form of legal sports betting available. Five others, including the large states of Washington and North Carolina, have authorized legal sports betting but not yet launched their market.

Major markets such as California, Texas, and Ohio remain in the shadows for the time being, while some legal markets such as New York have seen their growth hampered by restricting online betting options. However, even smaller markets are working towards a launch.

You can keep up with all the latest legal developments at the state level using our sports betting legalization tracker.

Here’s what Jeff Ifrah and Mark Balestra think of the market trajectory in the next five years:

What do you see as the future of sports betting in the United States over the next five years? Do you anticipate an acceleration in legalization efforts as legislatures look for new revenue streams post-COVID?

Balestra: It’s hard to get a read on what to expect because there’s no “normal” these days. Up to this point, the idea that the states’ need for money will accelerate legalization of gambling has been a bit of a misconception. In many states, the impact gambling revenue would have on budget deficits hasn’t been large enough to move the needle. Instead, policymakers seem to be motivated by consumers in their states spending money in neighboring states where sports betting is legal.

No doubt, the ability of residents to easily wager in nearby states has proven to be a major motivator for state legislatures. The ability of Chicagoland sports fans to place bets online after making the short drive to Indiana undoubtedly accelerated the lifting of in-person account registration requirements across Illinois.

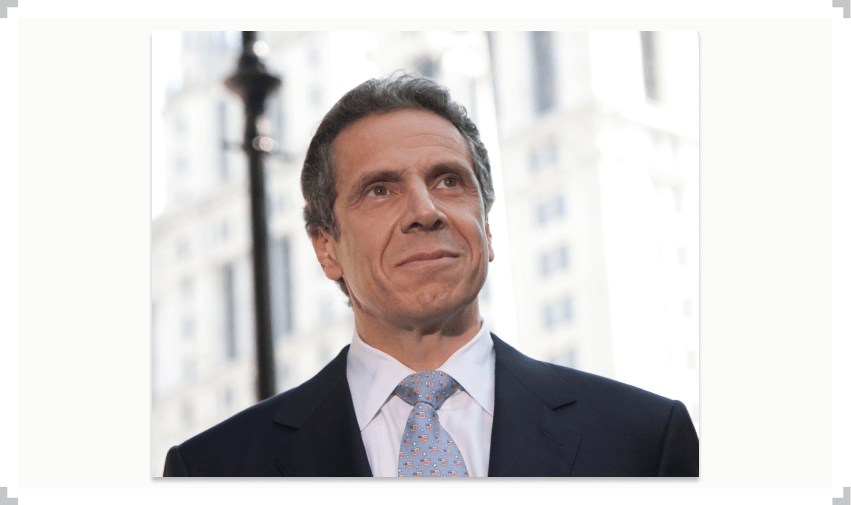

New York now seems likely to authorize online betting this year, which is largely the result of the state’s retail-only market struggling for market share against online options in nearby New Jersey and Pennsylvania. In fact, Governor Andrew Cuomo’s recent call for online expansion explicitly highlighted the fact that 20 percent of New Jersey sports bettors are in fact New York residents.

Expect to see more “regional clusters” with legal sports betting as legislatures seek to keep tax revenue from flowing across state lines.

Ifrah: The US passed the 50% mark in less than two and a half years, and every indication is that nothing is slowing down. The next big states that will pass authorizing legislation for mobile sports betting will be New York and Ohio. In addition, there is hope that as states authorize sports betting, those same states will quickly appreciate the benefits of also legalizing online poker and online casino. Indiana is one such state already considering adding these two important verticals to its existing sports betting market.

Efforts are underway to authorize online sports betting in both New York and Ohio. Bill A-1257 / S-1183 is currently under consideration in the New York State Assembly and Senate. Considering the broad public support and bipartisan sponsorship of the bill, the prospect of legal online betting in New York this year seems highly likely.

Meanwhile in Ohio, legislators are starving for a piece of the market rapidly expanding throughout the Appalachians and Upper Midwest – four of the five states that border Ohio already offer legal sports betting. Governor Mike DeWine (R) has stated unequivocally that “sports betting is coming to Ohio in 2021”. Senate Bill 111 failed to pass in 2020, but legislators have promised to consider revised legislation in the coming months.

Legal Sports Betting Rollout Surprises: What’s Weird About the Regulated Market?

In terms of major changes to social policy, the expansion of legal sports betting in the United States has occurred at breakneck speed. The rollout hasn’t been without its hiccups, but even longtime critics of expanded gaming have acknowledged the integrity and initial success of the burgeoning regulated market.

The evolving views of professional sports leagues and the NCAA is perhaps the strongest example of how the shift in policy has changed perspectives on the role of gaming in the larger sports and entertainment industry.

Here’s what Jeff Ifrah and Mark Balestra have to say about the evolution of the legal market so far:

What has surprised you most about the development of the legal sports betting market after the repeal of PASPA?

Ifrah: The speed at which states passed authorizing legislation and the speed at which mobile operators got up and running are two surprising developments post-Murphy. I can’t think of another industry that got itself up and running so quickly after the Supreme Court removed the barriers to do so. It is truly remarkable and perhaps a testament to the fact that people love sports!

People do, in fact, love sports. It’s important to recognize that making money is a secondary motivation for many casual fans now trying their luck with online betting apps. While everyone loves to make a quick buck, our research suggests that one in four fans bet on sports primarily to feel more involved in the game.

Regulators keen to promote responsible gaming should encourage operators and advertisers to focus on the experience of sports betting more than the potential financial upside. Such an approach looks increasingly likely as more professional and college teams ink marketing deals with sportsbook operators. As more stadiums are approved to accept wagers on-site, the “fun factor” of sports betting will only become more visible and relevant.

Balestra: I’m a little surprised there haven’t been more setbacks on the social side. I would have thought that by now we’d be seeing more attention drawn to social ills like gambling addiction. I’m also surprised at how few sports betting businesses collapsed in 2020 when organized sports all but disappeared. It appears that barriers to entry have ensured that unprepared, undercapitalized businesses have no place in a well-regulated market. Generally speaking, I would have expected more carnage coming out of such a horrific year.

The resilience of sportsbook operators is one of the most important industry takeaways from 2020. Despite the suspension of all sports just as new markets launched in several states, well-funded players like DraftKings, FanDuel, and BetMGM rode the storm off years of cash reserves and intense market speculation around future growth in the industry. These advantages allowed large firms to continue aggressive market expansion efforts at a time when some analysts expected the industry to be licking its wounds.

Of course, regulators also deserve some credit for adapting to these difficult circumstances. In Illinois, Governor J.B. Pritzker (D) quickly suspended the requirement for in-person account registration, allowing the market to become the fourth largest in the country rather than effectively forcing it to shut down. Elsewhere, state gaming boards were quick to authorize new wagering opportunities like table tennis betting when major sports hit the pause button.

Which Sportsbooks Will Dominate the Market?

Major players had a strong showing last year and bullish investors are confident that the largest online sports betting operators will dominate competition as the US sports betting market continues to mature.

Some states have licensed a relatively large number of operators, presenting a small window of opportunity for new players to shake up the game. Colorado, for instance, has licensed seventeen online operators at the time of writing.

We asked the experts if these little guys stand any chance to gain market share as more states come online with legal sports betting:

What is your take on competition within the US sports betting market? Is there space for smaller operators to get in the game, or will heavyweights such as FanDuel, DraftKings, and BetMGM further consolidate their dominant market share moving forward?

Balestra: Further consolidation is inevitable, and opportunity for smaller operators is fleeting. That said, there will always be opportunity on the B2B side for innovators. If you’re small and your end game is to rule the world, then your window has probably closed. However, if your model is to develop niche products and services to sell (or sell off) to the heavyweights, then there’s still money to be made.

SportsBettingDime.com will be keeping a close eye for new platforms or affiliate services that make a splash. Partnerships with lottery corporations in jurisdictions with a government monopoly on sports betting could provide one avenue for smaller names to gain influence, as recently demonstrated by Simplebet’s dealings in Montana and Washington, DC.

Ifrah: I think new entrants and small businesses need to appreciate that the US is a big country and the largest markets are not yet in play, such as, California, Texas and Florida. Further, even in robust markets such as New Jersey, there remains segments of the population that remain underserved by existing opportunities. It will be difficult for a new entrant to compete with FanDuel, DK and BetMGM from a market share perspective, but that does not mean that there is no market share available for such entrants. There are still loads of opportunities!

There’s little doubt that operators and investors are closely following any suggestions that sports betting could soon be legal in America’s three most populous states. As major media companies and professional leagues begin to partner with the largest online sportsbooks, their stranglehold on the market is likely to grow stronger.

Legal Sports Betting vs. Legal Marijuana: A Shared Success Story?

Across the United States, changing social attitudes have coincided with a rise in financial liabilities for state governments. These complementary factors have shifted social policy in many states to favor “sin taxes” and government regulation over outright prohibition when it comes to controversial issues such as substance use and gambling.

The legalization of recreational marijuana and sports betting share many parallels. They’ve occurred in the same general time period and political climate. Both have been regulated at the state level, with no coherent national policy in place to guide state lawmakers. Both have been major cash cows for both those in the industry and state governments looking for additional tax revenue.

We asked Mark and Jeff what they thought about the overlap between these emerging legal markets, and if there are any lessons those in the sports betting space can learn from the ongoing rollout of regulated marijuana.

How would you compare the development of the legal sports betting market with other major shifts in social policy, such as the development of the legal marijuana industry?

Balestra: For gambling, the transition has been from gray market to legalization. The blue-print for legalized sports betting – both online and offline – was established decades ago and has been refined over the years. For marijuana, the transition is from black market to legalization, and the blue-print for regulated sales of marijuana is more of a work in progress. I have a feeling there’s a lot more to learn about effectively regulating the legalized marijuana industry. In my home state of Missouri, for example, alleged bias in the license approval process resulted in numerous legal challenges brought by disgruntled declined applicants. The system is in need of reform, and perhaps they wouldn’t be in this predicament if there were an ideal, battle-tested regulatory model to follow.

Ifrah: I do not see any parallels between legal sports betting and progress by the marijuana industry. They really are two different industries supported by different segments of our society and each with its own merits and agendas. I am not an advocate for legalized marijuana and I know a lot of other sports enthusiasts who would agree with me.

Whatever your views on the legalization of marijuana or any other policy issue, the US is in a period of social transition. Importantly, these changes are being effected and regulated almost entirely at the state level, leading to a patchwork of rules and regulations across the country.

It’s key to understand that what’s legal in your state may not be legal everywhere. You can learn more about the specific rules in states with legal online sports betting at the links below:

- Arizona

- Colorado

- Connecticut

- Illinois

- Indiana

- Iowa

- Kansas

- Michigan

- New Jersey

- New York

- Pennsylvania

- Tennessee

- Virginia

- West Virginia

While we’re not entirely sure which states will legalize sports betting next, we are certain that more states will be joining the list above in the months to come.

Looking for More Sports Betting Legalization Coverage?

SportsBettingDime.com can help you navigate the everchanging landscape surrounding legal sports betting in the US.

Whether you’re looking for the best US betting apps and legal sportsbooks or simply want to learn more about sports betting legalization, our resources can help you make the most of new opportunities for safe and legal sports betting in America.

Let's have fun and keep it civil.